Laws governing a Knife

According to the case reports published by different authors, it is an understanding that knives or arms, in general, have its origin in the process of human evolution, the invention of these arms were made by humans for the purpose of hunting and self-defence. Knives from a long time have been part of the country’s culture it has been in the country in various sects or groups as the country now limited by the boundaries geographically but once was the land divided into the various kingdom.

Introduction

As the speedy progress of humanity and the growth of civilization, it became necessary to introduce laws regulating actions of the human being in society. The laws introduced in the societies by various scholars understanding the righteousness to be practised by the mankind made some action void or illegal, such actions were against the mankind, and it would result in disrupting the harmony of the society. The early end of kingships led into different revolution altogether resulting in the forming of the government. This administration was based on different philosophies and ideologies, realizing the contemplation of the world to make a better place. These authorities were formed according to the legislation for its incorporation and also derived their powers from such legislations.

The authorities were further subdivided into three parts forming the pillars on which the harmony and progress of the state will rely on, and the pillars were given authorities to make rules and regulation, to implement and watch the rules and regulation with nexus sought to be achieved for the state. It became a priority for the authorities to implement laws that were to be followed obediently, violating those would incur punishment for the person committing such an act. Many rules were written in terms of heinous crimes against mankind and were made punishable, and it came to the state’s attention that there is a need to invent legislation controlling the roots of this tree whose branches culminated into fruits of violation and brutality.

The ingredients involved- arms and ammunition to such brutality, the government understanding an urgent need to legislate the arms and its use by people or citizens of the land. Various countries made rules in this behalf according to the nature and objective the state wants to achieve through these rules. In India, as the country’s origin from the times of the British rules, modernization and literacy found its right characters in the land of scholars who decided to regulate brutal actions against mankind to be a punishable crime and legislated a charter of law enforceable by the authority to be known as Arms Act, 1959.

History of Knives Legislation

The history of knives legislation finds its origin mostly in the southern states of the United States of America, and the regulation introduced was in prohibitive nature to eliminate the use of the knife for dueling and other deadly sports between men for the purpose of entertainment.The rules made thereunder were different according to the type of knives considering the deadly nature. The knives in the early 19 th century were used in the west for much reason including settlement of the dispute and other quarrels regarding land disputes among gang members. To eliminate these casual ways of settling disputes by means of killing increased on a large scale where it became a priority to curb and eliminate this practice, it was made illegal bypassing law in this behalf. This law took a major turn after the Civil War in the USA; the laws were made more stringent with regards to purchasing and possession of the knives and other arms.

The law controlling the possession and use of the arms was first introduced in the year 1878 after the first uprising in the year 1857 but the laws made in the year arbitrarily allowed the sovereign to regulate the use of an arm at their own peril. After independence, it needed to create such rules that would require the government to meet its objective.

In the year 1959, the Government of India passed an Act, i.e. The Arms Act, 1959to legislate the acquisition, possession, use and disposal of arms in India in the late 50’s by studying the use of the arms and its use during the period of the British rule in India. The scholars in the country realized the grievous effects of the use of arm.

Legislation regulating Knives

In India, the arms and ammunition are regulated by the legislation passed by the parliament known as the Arms Act, 1959 and Arms Rule, 1962. According to the provision specified and rules in this behalf states that any person who is a law-abiding citizen will be allowed to have possession of the arms by the procedure established by the law. The provision incorporated was in effect from the year 1962, though such right to possess the firearms was not made the fundamental right but was accepted in the eye of law. This Act was enforced with the aim to regulate the use of arms and eliminate the trade and use of the illegal weapon. The rule states that any person under section 4 of the Arms Act, 1956 read with rules in Arms Rule, 1962 should not by any way acquire, possess, sale and use any arm or firearm whereby such arm is sharp edged and deadly by its very nature such as swords (including sword sticks), Dagger, Bayonets, spears (including lances and javelins), battle-axes, Knives (including Kirpan and khukeris) or any other arms whereby such arm has a blade which 9” longer and has wide breadth up to 2” broader for any purpose other than the purpose of domestic, agricultural, scientific, Industrial purposes, steel baton and all other weapons which are termed as “Life Preservers machinery used for making arms category other than 3 and any other weapon notified by the Central Government under section 4.

The use of knives in the way used or if such knives result in creating a disturbance or ruptures in any way the public tranquility, peace or if such piece of weapon creates an environment of fear would also be charged under the Criminal Procedure Code, 1973.

The use of any other weapon by any person by way of showing it or threatening it or to gain any undue advantage even without the intent of harming such person or group of such persons will be charged under section 425 of the Indian Penal Code.

Such a person will also be held liable under section 268 of the Indian Penal Code under an act of public nuisance if such blade or knives creates such a situation. According to various laws made under the Indian legislatures, such as Indian Penal Code, 1860 and Criminal Procedure Code, 1973.

Types of Knives

There is a list of knives mentioned in the list or schedules under the Arms Rules, 1962 that specifically mentioned and prohibited by the Government following:

1. Swords: The long metal bladeconsists of sharp edges sometimes on the inner and outer edges use of thrusting and attacking with force to cause an injury to someone in the act of war.This head in the rules also prohibits the swords sticks which are basically a walking stick or any stick mainly having a wooden covering from outside and blade or sword inside. Such sticks basically look like a walking stick.

2. Dagger: Dagger is typically a small knife which is used for stabbing some because of its double-edged sharpness on both the side of the metal blade makes a perfect knife for causing serious injury to person or animal.

3. Bayonets: The Bayonets are the type of knives that are typically seen on the rifle, it was majorly used by the armies or land warriors where they used this knife at the time for their defence. Such knives are now prohibited by the government.

4. Spears: A pointed blade used by the warriors that are made in way to cut the pressure of the air so as to hit the target by throwing it from a distance. It also tied or affixed to a wooden bamboo to kill someone at a distance.

Kirpans in India

A kirpan is a sword or knife that has special permission given by the Constitution of India, Article 25(2) (b) of the Constitution of India allows the carriage of Kirpan by the person who identifies himself/herself as Sikhs. As secularism forms an inevitable part of the Indian Constitution that provides to recognize the land will practice no religion symbolically of the country but such every religion will be accorded with the same reverence as to any other religion without any distinct nature of minority or majority. Further, the article also states that every person will be allowed and is free to practice, propagate and profess about his religion and recognizes every religion in its entirety with no modifications unless necessary.

Sikhs is one sect people originally from the northern part of the Indian Subcontinent. As per the Sikhism, tradition is practised, and it is vitally important for the people of this sect to follow the cultural identity in the way they practice, profess and propagate their religion. There is in a total of five articles compulsory as per the Sikh ideology to wear in a way to justice the religious necessity such as:

1. Haircovered by the turban.

2. Kara (a steel bracelet)

3. Kanga (a small wooden comb)

4. Kacchera (undershorts)

5. Kirpan (a small knife or sword)

A Kirpan is basically an article of faith in the Sikhism, and the word Kirpan has derived from two words, i.e. Kirpa and Aan, that literally means an act of kindness and self-respect respectively. This is symbolic of a belief that every person practising Sikhism should be generous and should always be protecting his/her self-respect. In Sikhism, the Kirpan has no specific size or requirement it depends upon the person who carries the Kirpan except it’s should sheathe and worn with a strap.

The Indian legislation, regulates the rules and regulation for the Kirpan, such that the Sikh or by any person without the authority of the Government or by any provision of the law will not be allowed to manufacture and sale the Kirpan. Though the word Kirpan has not been defined in the Arms Act but such arm will be included in the meaning of the sword. Under the precedence set by the Magistrate Court in,The Crown v/s Basta Singh, (1922) I.L.R III Lah. 437 wherein a Sikh was arrested under the charge of manufacturing and sale of Kirpan under section 19 (a) of Arms Act and presented before the Magistrate where the person arrested was released by the Magistrate by stating the reason that as per schedule 2 of the Arms Rules, a person identifying himself as Sikh will be allowed an exemption from prohibition regarding the manufacturing and sale of Kirpan. According to the new rules, any person though allowed to carry Kirpan in as an exception to the rule of carrying a knife in the country has limited and regulated with reference to its and size and shape.

Self- Defense legislation in India

An act of self-defence can be said as an act to protect oneself from any person willing to or by committing such an act which may result in the one’s death. The pardoning for any act where the person seriously injures or sometimes such injuries led to the death of that person came in the society in the medieval period, at such time to pardon such action it was at the sole discretion of the King. This was an attempt made by the administration and scholar who developed a sense of common understanding of the revolt of humanity against such crimes. In the case of the Brown v/s United States of America, Justice Holmes stated that it would more grievous crime committed by the states if such person would in turn for saving his life commits any action or cause any injury to a person willing to kill, would be allowed a pardon by the court of law. The principle of the uplifted knife is to be understood in the context of protection from such attacks but then such decision will be on the sole discretion of the court and might differ depending on the facts of the case.

In India, action of self-defence is considered as rightful action against the crimes that take place against mankind, it is governed by the Indian Penal Code. The IPC under sections 96 -106 covers the act of self-defence, there is various interpretation of a situation where acting to save one’s life would be a timely demand and committing any action pursued immediately in the phases of terror would be allowed a pardon. Such consideration based on the principle of “Necessity Knows No Law” it specifically states that if a situation arises were following a legal procedure to save his/her life would be terrible or delayed choice of action then such person can commit such act to mitigate the loss that will be caused to him/her, in turn, if such situation turns fatal then the court will have sole discretion depending on the facts of the case and evidence presented to recognize the eligibility of the action by an individual for pardon.

Though such action is due for pardon by the court carrying knife for such act is prohibited, the law states that any person carrying any arm or knife for such reason which does not comply with the requirement with regards to its shape and size will not be allowed for any such reason.

The Act states that any person in India will not be allowed to carry a knife which more the 9” long metal blade and 2” wide in size and such knife should be fancy in the way to be threatened by the public at large.

In the case of Malti Devi Singh & Others v/s The State of Uttar Pradesh, whereby the accuser’s conviction of causing injury to the respondent while acting in self-defence was considered by the court under the principle of the uplifted knife, the court set aside the order of the lower court for the appellant’s conviction provided a legal theory by an eminent jurist the Justice Holmes who stated that “a detached reflection cannot be demanded in the presences of an uplifted knife, the appellant.

In India the parliament has enlisted detailed laws regulating the states and action of citizens, in the above article, it was discussed at length various rules formed with due consideration for the use of arms. As the development is a concern, it is important to maintain the harmony of the state as the paramount interest of the administration, where any kind of fatal contemplation has to be avoided by way of legislating its use and other aspects relating to the commodity. The Indian legislature promulgates fairly codified provision enforceable in the country regulating the all the aspects of arms and ammunition. As this article discusses at lengththe permission to carry a knife with due consideration to the laws and provides a brief about the curtailment of the usage of knives. The rationale provided for prohibition suggests the procuring step in understanding the future recourse regarding such arms, as amendment still suggest the adaptability of the Act to limit the use of arms, for any purpose other than the qualified use as recognized by the states.

The article mainly covers the aspect of usage of Knives with its exception in recognizing the need to curb the sale and usage of it in any other illegal ways or for such purpose which is with intent to disrupt the public tranquility. The article also includes the exception provided by the state in this behalf and illustrates the understanding with regards to the case laws emphasizing that every exception has its onus upon the person who pursues such exception or requires the exceptional context to be considered for use that is in violation of the stated provision.

Lastly, it clears the understanding that the use of knives in any way has been prohibited by the Arms Act, 1959 read with Arms Rule, 1962, further the act in itself require a modification many aspects, but it may stay stringent with the rules made regulating the manufacture, sale, possession, use and trade in the way of the knife.

The author of this blog/Article is Kishan Dutt Kalaskar, a Retired Judge and practising advocate having an experience of 35+ years in handling different legal matters. He has prepared and got published Head Notes for more than 10,000 Judgments of the Supreme Court and High Courts in different Law Journals. From his experience he wants to share this beneficial information for the individuals having any issues with respect to their related matters .

Kishan Dutt Kalaskar

Advocate (Retired Judge)

No.74, 1 st Floor, 6 th Cross,

Did you find this write up useful? YES 26 NO 7 Dollie Hash 8 Mar 2023 7:21pmHi everyone, I was sad for so long when my husband left me. I searched for a lot of psychics who would help me but they all turned me down because I didn’t read more Hi everyone, I was sad for so long when my husband left me. I searched for a lot of psychics who would help me but they all turned me down because I didn’t have enough Dr Raypower had compassion and helped me and I am happy again as my husband is back home, cause this man has put in everything he had to help me and I will forever be grateful. I will encourage and recommend anyone to contact this psychic. He does all kinds of spells aside from love spells. You can reach out to him via WhatsApp +27634918117 or email: urgentspellcast@gmail.com visit his website: http://urgentspellcast.wordpress.com

Dr Mohan Ranawade 14 Nov 2022 7:48am Excellent write up Excellent write up Sher singh shekhawat 8 Sep 2021 5:54amNicely written and enough knowledge to make a decision about carrying one small piece for self defence Nicely written and enough knowledge to make a decision about carrying one small piece for self defence

.png)

Copyright © 2024. All Rights Reserved

Disclaimer: is not allowed to advertise and solicit work as per the rules and regulations of Bar Council of India. So it expressly disclaims any kind of warranty whether implied or expressed. Your use of service is completely at your own risk. Readers and Subscribers should seek proper advice from an expert before acting on the information mentioned herein. The content on this website is general information and not an advice on a particular matter.

In adherence to the rules and regulations of Bar Council of India, this website has been designed only for the purposes of circulation of information and not for the purpose of advertising.

Your use of SoOLEGAL service is completely at your own risk. Readers and Subscribers should seek proper advice from an expert before acting on the information mentioned herein. The content on this website is general information and none of the information contained on the website is in the nature of a legal opinion or otherwise amounts to any legal advice. User is requested to use his or her judgment and exchange of any such information shall be solely at the user’s risk.

SoOLEGAL does not take responsibility for actions of any member registered on the site and is not accountable for any decision taken by the reader on the basis of information/commitment provided by the registered member(s).By clicking on ‘ENTER’, the visitor acknowledges that the information provided in the website (a) does not amount to advertising or solicitation and (b) is meant only for his/her understanding about our activities and who we are.

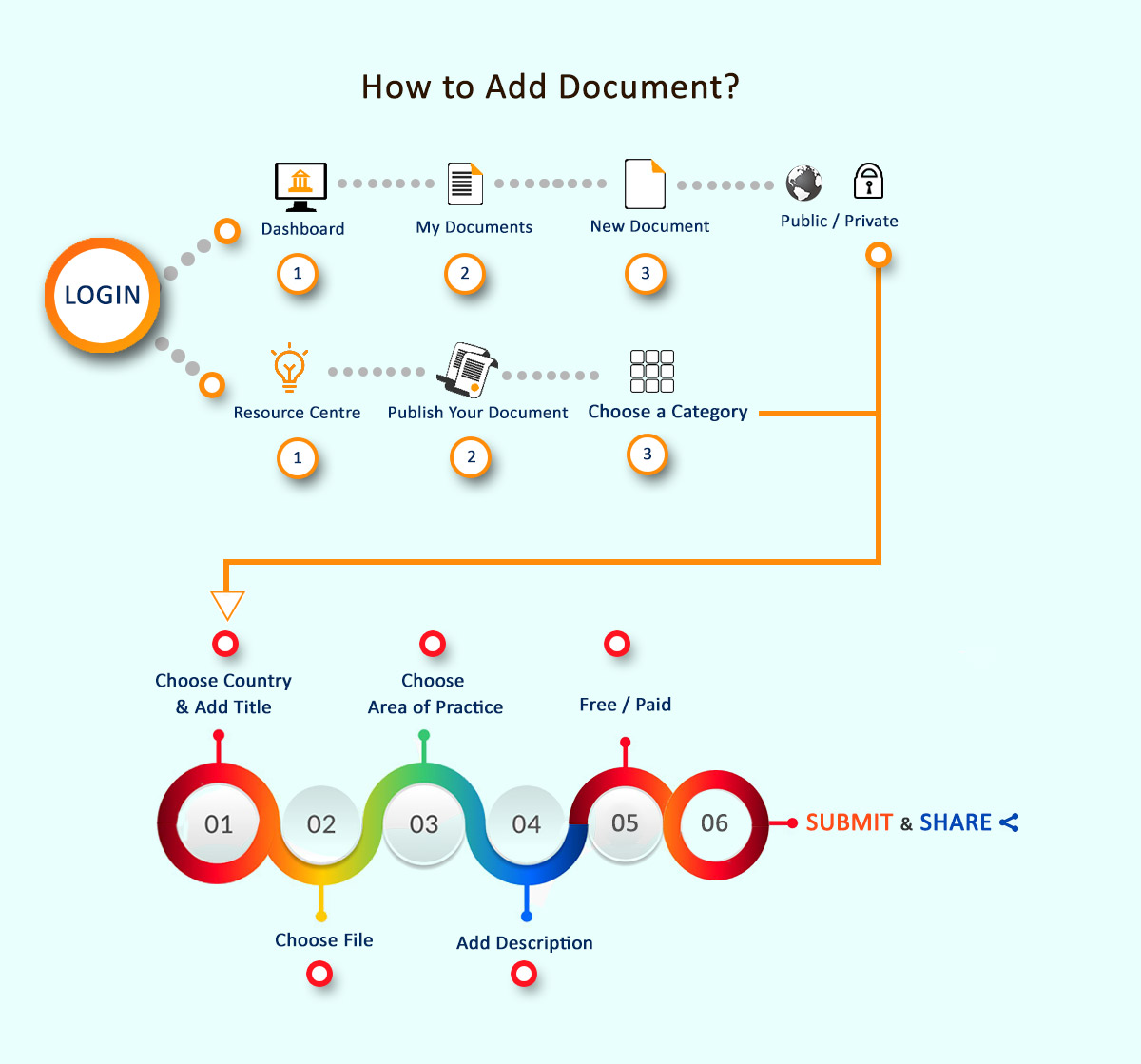

Resource centre is one stop destination for users who are seeking for latest updates and information related to the law. takes the privilege to bring every single legal resource to your knowledge in a hassle free way. Legal Content in resource centre to help you understand your case, legal requirements. More than 3000 Documents are available for Reading and Download which are listed in below categories:

×

SoOLEGAL Transaction Services Agreement :

By registering yourself with SoOLEGAL, it is understood and agreed by you that the Terms and Conditions under the Transaction Services Terms shall be binding on you at all times during the period of registration and notwithstanding cessation of your registration with SoOLEGAL certain Terms and Conditions shall survive.

"Your Transaction" means any Transaction of Documents/ Advices(s), advice and/ or solution in the form of any written communication to your Client made by you arising out of any advice/ solution sought from you through the SoOLEGAL Site.

Transacting on SoOLEGAL Service Terms:

The SoOLEGAL Payment System Service ("Transacting on SoOLEGAL") is a Service that allows you to list Documents/ Advices which comprise of advice/ solution in the form of written communication to your Client who seeks your advice/ solution via SoOLEGAL Site and such Documents/ Advices being for Transaction directly via the SoOLEGAL Site. SoOLEGAL Payment Service is operated by Sun Integrated Technologies and Applications . TheSoOLEGAL Payment System Service Terms are part of the Terms & Conditions of SoOLEGAL Services Transaction Terms and Conditionsbut unless specifically provided otherwise, concern and apply only to your participation in Transacting on SoOLEGAL. BY REGISTERING FOR OR USING SoOLEGAL PAYMENT SYSTEM , YOU (ON BEHALF OF YOURSELF OR THE FIRM YOU REPRESENT) AGREE TO BE BOUND BY THE TRANSACTIONS TRANSACTION TERMS AND CONDITIO NS .

Unless otherwise defined in this Documents/ Advice or Terms & Conditions which being the guiding Documents/ Advice to this Documents/ Advice, all capitalized terms have the meanings given them in the Transactions Transaction Terms and Conditions .

S-1. Your Documents/ Advice Listings and Orders

S-1.1 Documents/ Advices Information. You will, in accordance with applicable Program Policies, provide in the format we require. Documents/ Advices intended to be sold should be accurate and complete and thereafter posted through the SoOLEGAL Site and promptly update such information as necessary to ensure it at all times that such Documents/ Advices remain accurate and complete. You will also ensure that Your Materials, Your Documents/ Advices (including comments) and your offer and subsequent Transaction of any ancillary Documents/ Advice pertaining to the previous Documents/ Advices on the SoOLEGAL Site comply with all applicable Laws (including all marking and labeling requirements) and do not contain any sexually explicit, defamatory or obscene materials or any unlawful materials. You may not provide any information for, or otherwise seek to list for Transaction on the SoOLEGAL Site, any Excluded Documents/ Advices; or provide any URL Marks for use, or request that any URL Marks be used, on the SoOLEGAL Site. In any event of unlawful Documents/ Advices made available for Transaction by you on SoOLEGAL site, it is understood that liabilities limited or unlimited shall be yours exclusively to which SoOLEGAL officers, administrators, Affiliates among other authorized personnel shall not be held responsible and you shall be liable to appropriate action under applicable laws.

S-1.2 Documents/ Advices Listing; Merchandising; Order Processing. We will list Your Documents/ Advices for Transaction on the SoOLEGAL Site in the applicable Documents/ Advices categories which are supported for third party REGISTERED USERs generally on the SoOLEGAL Site on the applicable Transacting Associated Properties or any other functions, features, advertising, or programs on or in connection with the SoOLEGAL Site). SoOLEGAL reserves its right to restrict at any time in its sole discretion the access to list in any or all categories on the SoOLEGAL Site. We may use mechanisms that rate, or allow users to rate, Your Documents/ Advices and/or your performance as a REGISTERED USER on the SoOLEGAL Site and SoOLEGAL may make these ratings and feedback publicly available. We will provide Order Information to you for each of Your Transactions. Transactions Proceeds will be paid to you only in accordance with Section S-6.

S-1.3 a. It is mandatory to secure an advance amount from Client where SoOLEGAL Registered Consultant will raise an invoice asking for a 25 % advance payment for the work that is committed to be performed for the Client of such SoOLEGAL Registered Consultant. The amount will be refunded to the client if the work is not done and uploaded to SoOLEGAL Repository within the stipulated timeline stated by SoOLEGAL Registered Consultant.

b. SoOLEGAL Consultant will be informed immediately on receipt of advance payment from Client which will be held by SoOLegal and will not be released to either Party and an email requesting the Registered Consultant will be sent to initiate the assignment.

c. The Registered Consultant will be asked on the timeline for completion of the assignment which will be intimated to Client.

d. Once the work is completed by the consultant the document/ advi ce note will be in SoOLEGAL repository and once Client makes rest of the payment, the full amount will be remitted to the consultant in the next payment cycle and the document access will be given to the client.

e. In the event where the Client fails to make payment of the balance amount within 30 days from the date of upload , the Registered Consultant shall receive the advance amount paid by the Client without any interest in the next time cycle after the lapse of 30 days .

S-1.4 Credit Card Fraud.

We will not bear the risk of credit card fraud (i.e. a fraudulent purchase arising from the theft and unauthorised use of a third party's credit card information) occurring in connection with Your Transactions. We may in our sole discretion withhold for investigation, refuse to process, restrict download for, stop and/or cancel any of Your Transactions. You will stop and/or cancel orders of Your Documents/ Advices if we ask you to do so. You will refund any customer (in accordance with Section S-2.2 ) that has been charged for an order that we stop or cancel.

S-2. Transaction and Fulfilment, Refunds and Returns

S-2.1 Transaction and Fulfilment:

Fulfilment – Fulfilment is categorised under the following heads:

1. Fulfilment by Registered User/ Consultant - In the event of Client seeking consultation, Registered User/ Consultant has to ensure the quality of the product and as per the requirement of the Client and if its not as per client, it will not be SoOLEGAL’s responsibility and it will be assumed that the Registered User/ Consultant and the Client have had correspondence before assigning the work to the Registered User/ Consultant.

2. Fulfilment by SoOLEGAL - If the Registered User/ Consultant has uploaded the Documents/ Advice in SoOLEGAL Site, SoOLEGAL Authorised personnel does not access such Documents/ Advice and privacy of the Client’s Documents/ Advice and information is confidential and will be encrypted and upon payment by Client, the Documents/ Advice is emailed by SoOLEGAL to them. Client’s information including email id will be furnished to SoOLEGAL by Registered User/ Consultant.

If Documents/ Advice is not sent to Client, SoOLEGAL will refund any amount paid to such Client’s account without interest within 60 days.

3. SoOLEGAL will charge 5% of the transaction value which is subject to change with time due to various economic and financial factors including inflation among other things, which will be as per SoOLEGAL’s discretion and will be informed to Registered Users about the same from time to time. Any tax applicable on Registered User/ Consultant is payable by such Registered User/ Consultant and not by SoOLEGAL.

4. SoOLEGAL will remit the fees (without any interest) to its Registered User/ Consultant every 15 (fifteen) days. If there is any discrepancy in such payment, it should be reported to Accounts Head of SoOLEGAL (accounts@soolegal.com) with all relevant account statement within fifteen days from receipt of that last cycle payment. Any discrepancy will be addressed in the next fifteen days cycle. If any discrepancy is not reported within 15 days of receipt of payment, such payment shall be deemed accepted and SoOLEGAL shall not entertain any such reports thereafter.

5. Any Registered User/ Consultant wishes to discontinue with this, such Registered User/ Consultant shall send email to SoOLEGAL and such account will be closed and all credits will be refunded to such Registered User/ Consultant after deducation of all taxes and applicable fees within 30 days. Other than as described in the Fulfilment by SoOLEGAL Terms & Conditions (if applicable to you), for the SoOLEGAL Site for which you register or use the Transacting on SoOLEGAL Service, you will: (a) source, fulfil and transact with your Documents/ Advices, in each case in accordance with the terms of the applicable Order Information, these Transaction Terms & Conditions, and all terms provided by you and displayed on the SoOLEGAL Site at the time of the order and be solely responsible for and bear all risk for such activities; (a) not cancel any of Your Transactions except as may be permitted pursuant to your Terms & Conditions appearing on the SoOLEGAL Site at the time of the applicable order (which Terms & Conditions will be in accordance with Transaction Terms & Conditions) or as may be required Transaction Terms & Conditions per the terms laid in this Documents/ Advice; in each case as requested by us using the processes designated by us, and we may make any of this information publicly available notwithstanding any other provision of the Terms mentioned herein, ensure that you are the REGISTERED USER of all Documents/ Advices made available for listing for Transaction hereunder; identify yourself as the REGISTERED USER of the Documents/ Advices on all downloads or other information included with Your Documents/ Advices and as the Person to which a customer may return the applicable Documents/ Advices; and

S -2.2 Returns and Refunds . For all of Your Documents/ Advices that are not fulfilled using Fulfilment by SoOLEGAL, you will accept and process returns, refunds and adjustments in accordance with these Transaction Terms & Conditions and the SoOLEGAL Refund Policies published at the time of the applicable order, and we may inform customers that these policies apply to Your Documents/ Advices. You will determine and calculate the amount of all refunds and adjustments (including any taxes, shipping of any hard copy and handling or other charges) or other amounts to be paid by you to customers in connection with Your Transactions, using a functionality we enable for Your Account. This functionality may be modified or discontinued by us at any time without notice and is subject to the Program Policies and the terms of thisTransaction Terms & Conditions Documents/ Advice. You will route all such payments through SoOLEGAL We will provide any such payments to the customer (which may be in the same payment form originally used to purchase Your Documents/ Advices), and you will reimburse us for all amounts so paid. For all of Your Documents/ Advices that are fulfilled using Fulfilment by SoOLEGAL, the SoOLEGAL Refund Policies published at the time of the applicable order will apply and you will comply with them. You will promptly provide refunds and adjustments that you are obligated to provide under the applicable SoOLEGAL Refund Policies and as required by Law, and in no case later than thirty (30) calendar days following after the obligation arises. For the purposes of making payments to the customer (which may be in the same payment form originally used to purchase Your Documents/ Advices), you authorize us to make such payments or disbursements from your available balance in the Nodal Account (as defined in Section S-6). In the event your balance in the Nodal Account is insufficient to process the refund request, we will process such amounts due to the customer on your behalf, and you will reimburse us for all such amount so paid.

You will pay us: (a) the applicable Referral Fee; (b) any applicable Closing Fees; and (c) if applicable, the non-refundable Transacting on SoOLEGAL Subscription Fee in advance for each month (or for each transaction, if applicable) during the Term of this Transaction Terms & Conditions. "Transacting on SoOLEGAL Subscription Fee" means the fee specified as such on the Transacting on SoOLEGALSoOLEGAL Fee Schedule for the SoOLEGAL Site at the time such fee is payable. With respect to each of Your Transactions: (x) "Transactions Proceeds" has the meaning set out in the Transaction Terms & Conditions; (y) "Closing Fees" means the applicable fee, if any, as specified in the Transacting on SoOLEGAL Fee Schedule for the SoOLEGAL Site; and (z) "Referral Fee" means the applicable percentage of the Transactions Proceeds from Your Transaction through the SoOLEGAL Site specified on the Transacting on SoOLEGAL Fee Schedule for the SoOLEGAL Site at the time of Your Transaction, based on the categorization by SoOLEGAL of the type of Documents/ Advices that is the subject of Your Transaction; provided, however, that Transactions Proceeds will not include any shipping charge set by us in the case of Your Transactions that consist solely of SoOLEGAL-Fulfilled Documents/ Advices. Except as provided otherwise, all monetary amounts contemplated in these Service Terms will be expressed and provided in the Local Currency, and all payments contemplated by this Transaction Terms & Conditions will be made in the Local Currency.

All taxes or surcharges imposed on fees payable by you to SoOLEGAL will be your responsibility.

S-6 Transactions Proceeds & Refunds.

S-6.1.Nodal Account. Remittances to you for Your Transactions will be made through a nodal account (the "Nodal Account") in accordance with the directions issued by Reserve Bank of India for the opening and operation of accounts and settlement of payments for electronic payment transactions involving intermediaries vide its notification RBI/2009-10/231 DPSS.CO.PD.No.1102 / 02.14.08/ 2009-10 dated November 24, 2009. You hereby agree and authorize us to collect payments on your behalf from customers for any Transactions. You authorize and permit us to collect and disclose any information (which may include personal or sensitive information such as Your Bank Account information) made available to us in connection with the Transaction Terms & Conditions mentioned hereunder to a bank, auditor, processing agency, or third party contracted by us in connection with this Transaction Terms & Conditions.

Subject to and without limiting any of the rights described in Section 2 of the General Terms, we may hold back a portion or your Transaction Proceeds as a separate reserve (" Reserve "). The Reserve will be in an amount as determined by us and the Reserve will be used only for the purpose of settling the future claims of customers in the event of non-fulfillment of delivery to the customers of your Documents/ Advices keeping in mind the period for refunds and chargebacks.

S-6.2. Except as otherwise stated in this Transaction Terms & Conditions Documents/ Advice (including without limitation Section 2 of the General Terms), you authorize us and we will remit the Settlement Amount to Your Bank Account on the Payment Date in respect of an Eligible Transaction. When you either initially provide or later change Your Bank Account information, the Payment Date will be deferred for a period of up to 14 calendar days. You will not have the ability to initiate or cause payments to be made to you. If you refund money to a customer in connection with one of Your Transactions in accordance with Section S-2.2, on the next available Designated Day for SoOLEGAL Site, we will credit you with the amount to us attributable to the amount of the customer refund, less the Refund Administration Fee for each refund, which amount we may retain as an administrative fee.

"Eligible Transaction " means Your Transaction against which the actual shipment date has been confirmed by you.

" Designated Day" means any particular Day of the week designated by SoOLEGAL on a weekly basis, in its sole discretion, for making remittances to you.

" Payment Date" means the Designated Day falling immediately after 14 calendar days (or less in our sole discretion) of the Eligible Transaction.

" Settlement Amount" means Invoices raised through SoOLEGAL Platform (which you will accept as payment in full for the Transaction and shipping and handling of Your Documents/ Advices), less: (a) the Referral Fees due for such sums; (b) any Transacting on SoOLEGAL Subscription Fees due; (c) taxes required to be charged by us on our fees; (d) any refunds due to customers in connection with the SoOLEGAL Site; (e) Reserves, as may be applicable, as per this Transaction Terms & Conditions; (f) Closing Fees, if applicable; and (g) any other applicable fee prescribed under the Program Policies. SoOLEGAL shall not be responsible for

S-6.3. In the event that we elect not to recover from you a customer's chargeback, failed payment, or other payment reversal (a "Payment Failure"), you irrevocably assign to us all your rights, title and interest in and associated with that Payment Failure.

S-7. Control of Site

Notwithstanding any provision of this Transaction Terms & Conditions, we will have the right in our sole discretion to determine the content, appearance, design, functionality and all other aspects of the SoOLEGAL Site and the Transacting on SoOLEGAL Service (including the right to re-design, modify, remove and alter the content, appearance, design, functionality, and other aspects of, and prevent or restrict access to any of the SoOLEGAL Site and the Transacting on SoOLEGAL Service and any element, aspect, portion or feature thereof (including any listings), from time to time) and to delay or suspend listing of, or to refuse to list, or to de-list, or require you not to list any or all Documents/ Advices on the SoOLEGAL Site in our sole discretion.

S-8. Effect of Termination

Upon termination of this Contract, the Transaction Terms & Conditions automatiocally stands terminated and in connection with the SoOLEGAL Site, all rights and obligations of the parties under these Service Terms with regard to the SoOLEGAL Site will be extinguished, except that the rights and obligations of the parties with respect to Your Transactions occurring during the Term will survive the termination or expiration of the Term.

"SoOLEGAL Refund Policies" means the return and refund policies published on the SoOLEGAL Site.

"Required Documents/ Advices Information" means, with respect to each of Your Documents/ Advices in connection with the SoOLEGAL Site, the following (except to the extent expressly not required under the applicable Policies) categorization within each SoOLEGAL Documents/ Advices category and browse structure as prescribed by SoOLEGAL from time to time, Purchase Price; Documents/ Advice Usage, any text, disclaimers, warnings, notices, labels or other content required by applicable Law to be displayed in connection with the offer, merchandising, advertising or Transaction of Your Documents/ Advices, requirements, fees or other terms and conditions applicable to such Documents/ Advices that a customer should be aware of prior to purchasing the Documents/ Advices;

"Transacting on SoOLEGAL Launch Date" means the date on which we first list one of Your Documents/ Advices for Transaction on the SoOLEGAL Site.

"URL Marks" means any Trademark, or any other logo, name, phrase, identifier or character string, that contains or incorporates any top level domain (e.g., .com, co.in, co.uk, .in, .de, .es, .edu, .fr, .jp) or any variation thereof (e.g., dot com, dotcom, net, or com).

"Your Transaction" is defined in the Transaction Terms & Conditions; however, as used in Terms & Conditions, it shall mean any and all such transactions whereby you conduct Transacting of Documents/ Advices or advice sought from you by clients/ customers in writing or by any other mode which is in coherence with SoOLEGAL policy on SoOLEGAL site only.

Taxes on Fees Payable to SoOLEGAL. In regard to these Service Terms you can provide a PAN registration number or any other Registration/ Enrolment number that reflects your Professional capacity by virtue of various enactments in place. If you are PAN registered, or any professional Firm but not PAN registered, you give the following warranties and representations:

(a) all services provided by SoOLEGAL to you are being received by your establishment under your designated PAN registration number; and

SoOLEGAL reserves the right to request additional information and to confirm the validity of any your account information (including without limitation your PAN registration number) from you or government authorities and agencies as permitted by Law and you hereby irrevocably authorize SoOLEGAL to request and obtain such information from such government authorities and agencies. Further, you agree to provide any such information to SoOLEGAL upon request. SoOLEGAL reserves the right to charge you any applicable unbilled PAN if you provide a PAN registration number, or evidence of being in a Professional Firm, that is determined to be invalid. PAN registered REGISTERED USERs and REGISTERED USERs who provide evidence of being in Law Firm agree to accept electronic PAN invoices in a format and method of delivery as determined by SoOLEGAL.

All payments by SoOLEGAL to you shall be made subject to any applicable withholding taxes under the applicable Law. SoOLEGAL will retain, in addition to its net Fees, an amount equal to the legally applicable withholding taxes at the applicable rate. You are responsible for deducting and depositing the legally applicable taxes and deliver to SoOLEGAL sufficient Documents/ Advice evidencing the deposit of tax. Upon receipt of the evidence of deduction of tax, SoOLEGAL will remit the amount evidenced in the certificate to you. Upon your failure to duly deposit these taxes and providing evidence to that effect within 5 days from the end of the relevant month, SoOLEGAL shall have the right to utilize the retained amount for discharging its tax liability.

Where you have deposited the taxes, you will issue an appropriate tax withholding certificate for such amount to SoOLEGAL and SoOLEGAL shall provide necessary support and Documents/ Adviceation as may be required by you for discharging your obligations.

SoOLEGAL has the option to obtain an order for lower or NIL withholding tax from the Indian Revenue authorities. In case SoOLEGAL successfully procures such an order, it will communicate the same to you. In that case, the amounts retained, shall be in accordance with the directions contained in the order as in force at the point in time when tax is required to be deducted at source.

Any taxes applicable in addition to the fee payable to SoOLEGAL shall be added to the invoiced amount as per applicable Law at the invoicing date which shall be paid by you. F.11. Indemnity

Certain Documents/ Advices cannot be listed or sold on SoOLEGAL site as a matter of compliance with legal or regulatory restrictions (for example, prescription drugs) or in accordance with SoOLEGAL policy (for example, crime scene photos).

SoOLEGAL's policies also prohibit specific types of Documents/ Advice content. For guidelines on prohibited content and copyright violations, see our Prohibited Content list.

For some Documents/ Advice categories, REGISTERED USERS may not create Documents/ Advice listings without prior approval from SoOLEGAL.

Registered Users must at all times adhere to the following rules for the Documents/ Advices they intend to put on Transaction:

The "Add a Documents/ Advice" feature allows REGISTERED USERS to create Documents/ Advice details pages for Documents/ Advices.

The following rules and restrictions apply to REGISTERED USERS who use the SoOLEGAL.in "Add a Documents/ Advice" feature.

Prohibited REGISTERED USER Activities and Actions

SoOLEGAL.com REGISTERED USER Rules are established to maintain a transacting platform that is safe for buyers and fair for REGISTERED USERS. Failure to comply with the terms of the REGISTERED USER Rules can result in cancellation of listings, suspension from use of SoOLEGAL.in tools and reports, or the removal of transacting privileges.

REGISTERED USERS are expected to conduct proper research to ensure that the items posted to our website are in compliance with all applicable laws. If we determine that the content of a Documents/ Advice detail page or listing is prohibited, potentially illegal, or inappropriate, we may remove or alter it without prior notice. SoOLEGAL reserves the right to make judgments about whether or not content is appropriate.

The following list of prohibited Documents/ Advices comprises two sections: Prohibited Content and Intellectual Property Violations.

Listing prohibited content may result in the cancellation of your listings, or the suspension or removal of your transacting privileges. REGISTERED USERS are responsible for ensuring that the Documents/ Advices they offer are legal and authorised for Transaction or re-Transaction.

If we determine that the content of a Documents/ Advice detail page or listing is prohibited, potentially illegal, or inappropriate, we may remove or alter it without prior notice. SoOLEGAL reserves the right to make judgments about whether or not content is appropriate.

YOU HAVE AGREED TO THIS TRANSACTION TERMS BY CLICKING THE AGREE BUTTON